Individuals Articles

1. Douglas Edwards: Google Employee No 592. Ray Dalio Bridgewater Hedge Fund

3. Philip Leakey

4. Alan Whicker

5. Michael Palin

6. Neil Gaiman

7. Baldrick

8. Kenny Everett

9. Ronnie Wood

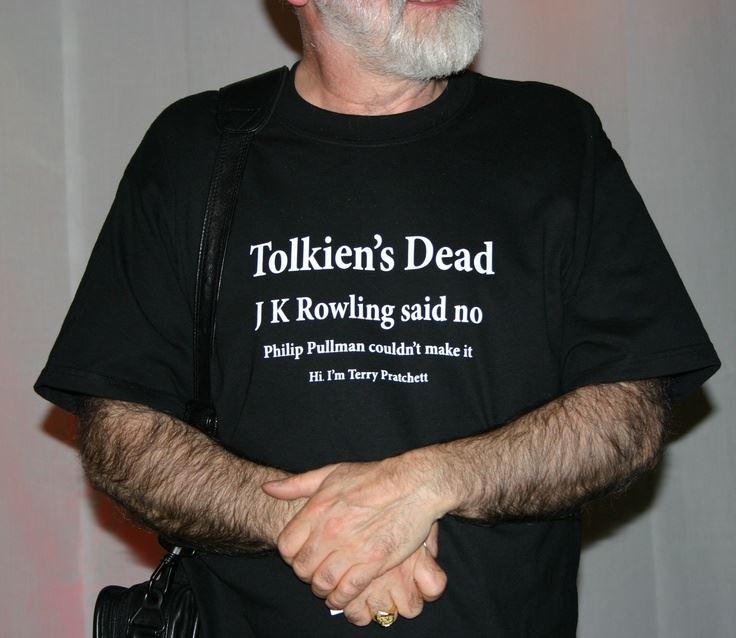

10. Terry Pratchett

11. Lucian Freud

12. Ray Davies

13. Ronald Coase, Economist

14. Michael O'Leary - RyanAir

15. Jony Ive

16. Alain de Botton

17. Freddie Mercury

18. Richard Dawkins

19. Peter Thiel

20. Ego Fundamentalists

21. Neil Sedaka

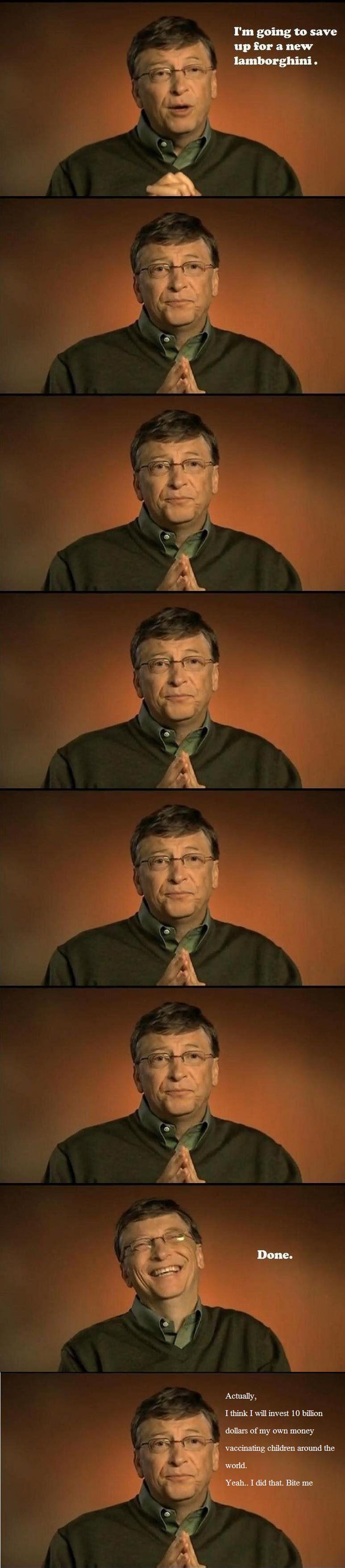

22. Bill Gates

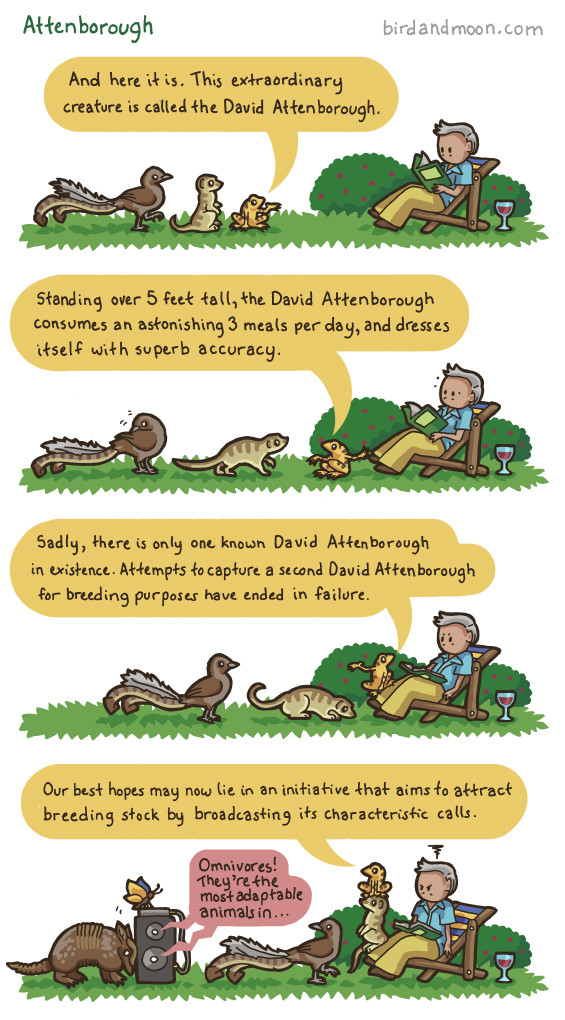

23. David Attenborough

24. Roy Trubshaw and Richard Bartle

25. Erik Finman

26. James Smithson

27. Harley Earl

28. Victor Watson

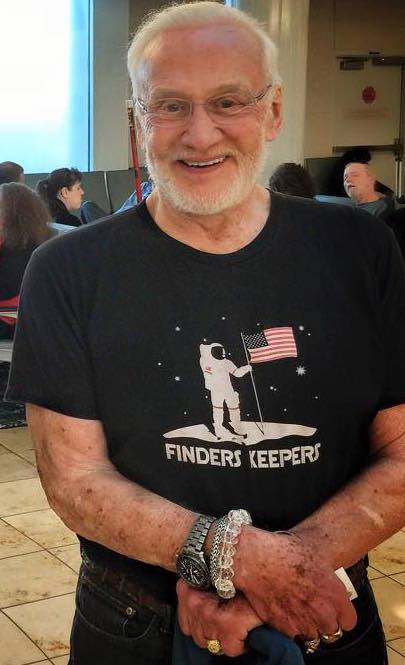

29. Buzz Aldrin

30. Terry Pratchett

31. Felix Dennis

32. Michael Gambon

33. Dick Frizzell

34. Nigel Richards

35. Warren Bennis

36. Steve Jobs

37. Lowell Wood, the Modern Day Thomas Edison

38. Patricia Cornwell

39. Robert Stigwood

40. Marc Andreessen

41. Anthony Bourdain on Reddit

42. Katherine Johnson

43. "Poppy" Huston and the Spitfire

44. James Dyson

45. Suzi Quatro

46. Elon Musk

47. Charlie Watts

48. Robert Crumb

49. Jimmy Buffett

50. Pauline Boty

51. William Lever

52. Kaleb Cooper

53. Lisa Marie Presley

54.

55.

56.

57.

58.

59.

Douglas Edwards: Google Employee No 59

-

In 1998 two Stanford University PhD students, Larry Page and Sergey Brin, started a company whose aim was: "To organise the world's information and make it universally accessible and useful." Eleven years later, the company has a value of $172 billion, has one billion users every year and fulfils more than one billion search requests per day. Douglas Edwards took a pay cut to join Google in 1999, aged 41, as director of consumer marketing and brand management when the company had fewer than 60 employees. He left five years later a tired, relieved millionaire.

Cindy McCaffrey, director of public relations, brought me back to the conference room to wait for Sergey. I wasn't nervous. Sergey was about the age of my favourite T-shirt and a Russian by birth. I had lived in Russia. I spoke some Russian. I had Russian friends. I understood their dark humour, their cynical views and their sarcastic ways. I felt unusually confident that the interview would go well. Perhaps I would become his mentor and we would toast each other's health with fine Siberian vodka. Sergey showed up wearing roller hockey gear: gym shorts, a T-shirt and inline skates. He had obviously been playing hard. I had known better than to wear a tie, but he took office casual to a new level.

I sat back and resumed toying with one of the rubber balls, feeling so relaxed that I accidentally removed its stopper, causing half the air inside to rush out with a hiss. Sergey found that amusing. He pored over my resume, and began peppering me with questions. "What promotion did you do that was most effective?" "What metrics did you use to measure it?" "What types of viral marketing did you do?" "How much do you think a company our size should spend on marketing?" Sergey asked me. Based on his earlier questions, it was easy to guess what he wanted to hear from me.

"I don't think at this stage you should spend much at all," I said. "You can do a lot with viral marketing and small budgets. Shooting gerbils out of a cannon in a Super Bowl spot isn't really a very effective strategy for building a brand." He nodded his agreement, then asked about my six months in Siberia, casually switching to Russian to see how much I had picked up. Finally, he leaned forward and fired his best shot, what he came to call "the hard question".

"I'm going to give you five minutes," he told me. "When I come back, I want you to explain to me something complicated that I don't already know." He then rolled out of the room towards the snack area. I looked at Cindy. "He's very curious about everything," she told me. "You can talk about a hobby, something technical, whatever you want. Just make sure it's something you really understand well."

I reached for a piece of scrap paper as my mind raced. What complicated thing did I know well enough to describe to Sergey? Nappy-changing didn't seem appropriate. How newspapers are printed? Kind of dull. I decided to go with the general theory of marketing, which was fresh in my mind, because I'd only learnt it recently.

One of my dirty little secrets was a complete lack of academic preparation for the business world. Instead of statistics and economics, I'd taken planetary geology, Latin and Spenserian verse. Fortunately, Annie Skeet, my boss at the Mercury News, had a Harvard MBA and a desire to drive some business theory into my thick skull. She had given me a bunch of her old textbooks along with strong hints I should spend time reading them. I had found a couple of titles interesting, including Porter's Competitive Strategy and Aaker's books on branding. I began regurgitating everything I could remember on to the paper in front of me: the five Ps (or was it six?), the four Ms, barriers to entry, differentiation on quality or price. By the time Sergey came back, I had enough to talk for ten minutes and was confident I could fill any holes with the three Bs (Buckets of Baffling Bulls***). I went to the whiteboard and began drawing circles and squares and lots of arrows. I was nervous, but not very. Sergey bounced on a ball and asked questions that required me to make things up on the spot.

"What's the most effective barrier to entry?"

"What's more important: product differentiation or promotion?"

"How does the strategy change if the price is zero?"

He seemed to be paying attention and I began enjoying myself. We were developing a special rapport! Clearly, he wanted to hear what I had to say and valued my opinions. Later I found out that Sergey did this with everyone he interviewed. An hour wasted with an unqualified candidate wasn't a total loss if Sergey gained insight into something he didn't already know.

The light was fading by the time I finished and Sergey invited me to join the staff for dinner, which was being brought into a small kitchen across from the conference room. A crowd of hungry engineers bounced from plate to plate with chopsticks picking at a large selection of sushi.

"We just hired a chef, so this is a temporary set-up," Sergey told me. "And we've got a couple of massage therapists coming in as well."

A warning light flashed in my head at that. This was the guy who didn't think there should be a marketing budget, and he had hired a chef and two massage therapists? But then I saw the platters of fatty tuna and shrimp and salmon and yellowtail. I grabbed some chopsticks and began loading my plate. Concerns about a business plan and revenue streams and organisational structure faded away. Google met most of my requirements. It offered at least the appearance of superior internet-related technology, some eccentric genius types, funding that should last at least a year and a fun consumer brand that I could help develop. Two weeks later, on November 29, 1999, I started work as Google's online brand manager. You would have needed uncanny foresight or powerful pharmaceuticals to envision Google's success in 1999. Or maybe just money to burn. Kleiner and Sequoia had something, because the two venture capital firms invested $12.5 million each, leading cynics in the Valley to define "googling" as "getting funding without a business plan".

What did it feel like? I mean the experience of coming to work at Google when it was fewer than 60 people? Let me give you a few impressions. Before I started at Google, I had never said any of the following on the job:

"Yes, I see the eight shelves of programming books. Where do we keep the dictionaries? No, I can't just print out the words as I look them up online."

"Is it a good idea to have all those bikes leaning against the fire door?"

"Sorry. Did I get the printer? Super Soakers are really inaccurate at more than 15 feet."

"Who do I ask if I have questions about Windows? No one? Really?"

"Wow Larry. Who trashed your office? Well, it's just that... uh, never mind."

"Wouldn't it be easier to buy Rollerblade wheels that are already assembled?"

"Is there any way to set the sauna for more than half an hour?"

"Is it OK to go into the women's locker room to steal some towels?"

"Oh sorry. Didn't realise anyone was napping in here."

"See, you knock down more garbage cans if you bounce the ball instead of just rolling it straight at them."

"It's in the area behind the coffee can pyramid, right across from where the Big Wheel is usually parked."

Google was growing. The company was still self-contained in a single building when the millennium began, but the offices lining the outer edges of the Googleplex had all been occupied.

One day a crew of Pacific Islanders - their thick biceps shrink-wrapped in coconut-leaf tattoos - arrived to fill the open space with cubicles. The area was now partitioned by a maze of cheaply acquired, mismatched fabric panels; the flotsam and jetsam of the dotcoms that had suddenly started sinking all around us. Fast-food toys, manipulative puzzles, empty soda cans and geek-chic objects feathered the work nests. Ratty couches shambled through open areas and settled on brightly coloured crop circles cut into the carpeting, offering lumpy, coffee-stained comfort and filling in for laundry hampers. I brought in a couple of 4ft inflatable dinosaurs and left them to graze on the new flooring.

Walking the grey padded arroyos, I glimpsed the backs of many heads, staring intently at screens. It sounds deadly dull, but there was an energy to the place - conveyed in quiet conversations, snatches of laughter, the squeak of dry-erase markers on rolling whiteboards, exercise balls bouncing and electric scooters humming down hallways.

The head of engineering's woolly mammoth of a dog, Yoshka, ambled past - ears flapping, collar jingling. Someone flopped on a couch, took off their skates and dropped them on the floor. Someone ground coffee beans for an afternoon espresso. A pool cue slapped a cue ball. It passed the aggression on - smacking an eight-ball loitering in its path and sending it into the deep funk of a faux-leather pocket.

I felt the tension of potential - building and bound only by time - like crossing the tracks in front of an idling train. Great efforts were being made. They vibrated just beyond the visible, rippling outward and seeking physical release. Sometimes that physical release took an intimate form behind closed doors with a willing partner. "Hormones were flying and not everyone remembered to lock their doors," recalls HR manager Heather Carnes.

Larry and Sergey encouraged everyone to channel their excess energy into roller hockey instead. Any employee who signed up was issued a free jersey emblazoned with his or her name and Google's logo. Hockey provided yet another metric by which Googlers could be evaluated.

"There is no better way to get to know someone," facilities manager George Salah, a regular participant, believed. "To have their true colours come out, play sports with them. You get to see how aggressive they are, if they're ruthless or not, if they're capable of giving 110 per cent."

At the age of 41, I had much to prove. I voiced objections based on "irrelevant" experience gained over a 20-year career. I drove a station wagon that smelt of baby wipes and spit-up. I didn't want the unripened grads with whom I shared the locker room to assume I was slowing down physically or mentally. One afternoon, the receptionist called. "Doug, can you come downstairs? Sergey asked if you could load his scuba gear in the car. He said you're the strongest guy here." "Sure," I replied. Halfway to the lobby, I slowed down. Then I stopped. The founder of the company wanted me to do his scutwork. That couldn't be good, could it? But Sergey felt I was uniquely capable. That was a plus, right? I was glad to be singled out, but embarrassed about the reason for it. Was I that in need of recognition? Google's obsession with metrics was forcing me to take stock of my own capabilities. What did I bring to the table? What were my limits? How did I compare? Insecurity was a game all Googlers could play, especially about intellectual inferiority.

Everyone but a handful felt they were bringing down the curve. I began to realise how closely ambition linked to insecurity and how adeptly Google leveraged the latter to inflate the former - urging us to pull ever harder to advance not just ourselves, but the company as whole.

Towards the end of my Google run, a newly hired senior manager put into words what I had discovered long before. "Let's face it,Doug," he confided to me, "Google hires really bright, insecure people and then applies sufficient pressure that - no matter how hard they work - they're never able to consider themselves successful. Look at all the kids in my group who work absurd hours and still feel they're not keeping up with everyone else."

I had to agree that fear of inadequacy was a useful lever for prying the last drop of productivity out of dedicated employees. Everyone wanted to prove they belonged among the elite club of Google contributors. The manager who articulated that theory, though, considered himself too secure to play that game. Which may be why he lasted less than a year at Google.

Many of my overcaffeinated twentysomething colleagues had relocated from outside the Bay Area. They had no local friends, no attachments, no relatives to distract them. They had Google. It was hard to let go of the absolutes I had clung to so tightly over a long career of managing brands. Sergey tried to help me by prying tenets from my rigid belief system and beating me over the head with them. Case in point, the daily affirmation I chanted to our logo's inviolate purity. "This is our logo." "It looks like this." "If it looks like this, it's our logo." "Because our logo looks like this." One of the convictions I brought with me to Google, based on the two books I had read about branding, was that you needed to present your company's graphic signature in a monomaniacally consistent manner; to pound it into the public consciousness with a thousand tiny taps, each one exactly the same as the one before.

So when Sergey reminded me that he wanted us to play with Google's signature home-page graphic, I put my foot down. Remember, this was not only the most prominent placement of our logo; it was the only placement of our logo. We weren't advertising on TV or on billboards or in print. The logo floating in all that white space was it. And though we had millions of users, we were hardly so well known that we could assume people already had our brandmark burned into their brains.

Sergey didn't see the big deal. He had changed the logo twice during Google's infancy, adding a clip-art turkey on Thanksgiving, 1998, and putting up a Burning Man cartoon when the staff took off to explore nakedness in the Nevada desert. But now Google was a real company, I told him. Real companies don't do that. Even as we argued, Sergey enlisted webmaster Karen White to resurrect the turkey for Thanksgiving, create a holiday snowman in December, and festoon the logo with a hat and confetti for New Year's 2000. "What about aliens?" he asked. "Let's put aliens on the home page. We'll change it every day. It will be like a comic strip that people come back to read."

I tried not to be condescending. I explained again why it was bad branding. I gave him my spiel about consistency of messaging and uniform touch points and assured him it wasn't just my opinion; it was the consensus of marketing professionals worldwide. Manipulating one's logo was identity dilutionary.

I knew I had finally convinced him when he stopped asking me about it. I was wrong. Sergey wasn't convinced; he just didn't like repeating himself. So he turned to marketing manager Susan Wojcicki instead. Susan didn't argue - she started looking for an artist to execute Sergey's vision. She found illustrator Ian Marsden and put him to work. In May 2000, Ian created the first Google doodle. It featured, surprise, surprise, aliens making off with our logo. NYU professor Ken Perlin created a bouncing heart applet for Valentine's Day and a bouncing bunny game for Easter. Larry showed his gratitude with an offer of Google stock sufficient to make the code Ken sent us - line for line - quite possibly the most expensive ever written.

Our users loved the randomness of the logo artwork and sent us dozens of appreciative e-mails. Google's brilliant strategy of humanising an otherwise sterile interface with cute little cartoon creatures was an enormous hit and as the company's online brand manager - the person responsible for building Google's awareness and brand equity - I had opposed it as adamantly as I could. Yes, if it had been left to me, there would be no Google doodles at all; just our cold stiff logo lying in state, wrapped in a sterile sheet of pristine white pixels.

It was so blindingly obvious that I was right, yet I was so clearly wrong. Google did that to you - made you challenge all your assumptions and experience-based ideas until you began to wonder if up was really up, or if it might not actually be a different kind of down. A month after we bought an online archive of Usenet posts known as Deja News, 140 Googlers packed up overnight bags, boarded a fleet of buses and headed for the hills. It was time for Google's annual ski trip.

The ritual started when Google was just eight people and Larry drove a rented van to Lake Tahoe while Sergey, Craig, Ray and Harry killed time playing logic games in the back and Heather struggled to stay awake. The group saved $2.50 a day by designating Larry the only driver, which was a given anyway because Larry wasn't about to put his life in anyone else's hands.

I didn't go with the group in 2000, even though it was clear that the ski trip was not optional. The trip was a team-building exercise and thus only for staff members. No family. That didn't sit well with my wife, Kristen, who had already seen enough at Google to have reservations. The tipping point may have been the day she came to lunch and noticed an attractive twentysomething woman whose thong underwear was all too visible through her sheer harem pants.

"Who's that?" my wife whispered directly in my ear as the woman slid her tray past the entrees toward the desserts. "Oh, just one of the engineers," I replied. "She rides a motorcycle," I offered helpfully. So when I told Kristen that Google required my presence at Lake Tahoe for an employeeonly bonding trip, what she heard was, "Please stay at home with our three children while I head out with a busload of adrenalin-charged, hormone-drenched post-adolescents for three days of bacchanalian binge-drinking, substance abuse and room-key swapping."

As usual, she got it mostly right. I know, because the next year, I convinced her my career would be damaged if I didn't go along. Google lodged us at the elegant Resort at Squaw Creek. It wouldn't cost me anything and it was only for a couple of days. Please, honey? Please? While I'm proud to say I was so hopelessly unhip that I missed out on anything more decadent than a late-night soak in an outdoor hot tub with Larry and a dozen others, it was clear others were showing less restraint.

I heard tales of excess involving not only recent college graduates, but those who had the years and experience to know better. Many of these tales coincidentally began with a visit to 'Charlie's Den' - the room Chef Charlie Ayers occupied with Keith from accounting and an SUV-load of liquor ferried up from Mountain View. As the trip grew in scale and Charlie's hospitality grew in reputation, the party relocated to a luxury suite and then a meeting room with an open bar sporting $75,000 worth of booze and a supply of other social lubricants including herbinfused brownies and dark chocolate gooballs. Out of coincidence, or perhaps the perverse humour of the HR folks managing the event, Larry's room was usually adjacent to the party. One year, all the liquor was unloaded into Larry's suite by mistake. Larry didn't drink, though he carried a thimble-full of beer at parties to put others at ease.

"My mind is money," Larry once told Charlie, pointing to a bottle, "and that kills the brain." "I think he could spare a few brain cells," Charlie told me later. Other members of the executive staff more willingly sacrificed bits of grey matter, and Charlie would make sure their rooms were stocked with their favourite indulgences in case they didn't make it to the party in the Den.

"It's always cool to see people let loose and have a good time," Charlie observed, confirming the opportunities for staff bonding. "Googlers really let go in ways you wouldn't have seen otherwise." He may have had in mind the toga-wearing ops guys who were only too willing to prove they were unburdened by underwear. Or maybe the sales rep who jumped on the back of another Googler, pulled off her own shirt and began whipping him with it jockey style. Or perhaps, the senior manager seen crawling on all fours, barking like an inebriated hound in the hallway. Preparation tip: don't cook the flavouring ingredient more than once because it loses its potency that way.

There was a pyjama party with costume prizes. Larry won a bet with Sergey, Salar and engineer Lori Park that ended with the losers jumping into an icy Lake Tahoe after dinner.

"We tried to recreate Google's 'un-corporation' attitude," Charlie Ayers explained to me, "a kind of 'f*** you' to the man - the way Google was saying that same thing to the tech industry as a whole."

By 2007, the size of the company made the annual ski trip impossible and Google ended it in favour of smaller outings to more family-friendly locales like Disneyland. That's probably a good thing, though I'll always cherish the scars I earned at broomball and the camaraderie of shared experiences on the slopes and in the lodge. I've heard the speculation about Google since I've left. That it's a monopoly. That it's tracking users. That it's in cahoots with the government. That it spies on people. That it's evil.

Well, maybe it is all that. I haven't worked there in more than five years. Things change. But, based on the people I knew during my time in the Plex - many of whom still put in long hours perfecting a product used by millions every day - I'd say that's highly unlikely.

Is Google secretive? No question. Arrogant? Maybe. Tone-deaf to the concerns of the very users it claims to serve? Occasionally. But evil? I don't think so. I started my career working at ad agencies. It was fun, challenging and potentially wellpaying. I quit because I didn't like the idea I might have to sell something I didn't believe in. I worked in public broadcasting and then newspapers, where I found co-workers who sacrificed material rewards to be part of something more connected to the common good than selling someone else's products. I got that same sense at Google, but with greater intensity and urgency. And stock options. This was no institution continuing a long tradition of public service. This was a headlong rush to reshape the world in a generation. And therein lies the company's biggest flaw in my estimation - impatience with those not quick enough to grasp the obvious truth of Google's vision.

"When were we ever wrong?" Larry asked me.

Not often. But "not often" is not never. If Google's leaders accepted that reality, they might understand why some people are unwilling to suspend scepticism and surrender to Google's assurances the company can be trusted. After Google, I find myself impatient with the way the world works. Why is it so hard to schedule a recording on my DVR? Why aren't all the signal lights synched to keep traffic flowing at optimum speed? Why, if I punch in my account number when I call customer service, do I have to give it to them again when I get a live person? These are all solvable problems. Smart people, motivated to make things better, can do almost anything. I feel lucky to have seen first-hand just how true that is.

Ray Dalio Bridgewater Hedge Fund

-

Ray Dalio, the sixty-one-year-old founder of Bridgewater Associates, the world's biggest hedge fund, is tall and somewhat gaunt, with an expressive, lined face, gray-blue eyes, and longish gray hair that he parts on the left side. When I met him earlier this year at his office, on the outskirts of Westport, Connecticut, he was wearing an open-necked blue shirt, gray corduroy pants, and black leather boots. He looked a bit like an aging member of a British progressive-rock group. After a few pleasantries, he grabbed a thick briefing book and shepherded me into a large conference room, where his firm was holding what he described as its weekly "What's going on in the world?" meeting.

Of the fifty or so people present, most were clean-cut men in their twenties or thirties. Dalio sat down near the front of the room. A colleague began describing how the European Central Bank had just bought some Greek bonds from investors at a discount to their face value—a move that the speaker described as a possible precursor to an over-all restructuring of Greece’s vast debts. Dalio interrupted him. He said, “Here’s where you are being imprecise,” and then explained at length what a proper debt restructuring would entail, dismissing the E.C.B.’s move as an exercise in “kicking it down the road.”

Dalio is a “macro” investor, which means that he bets mainly on economic trends, such as changes in exchange rates, inflation, and G.D.P. growth. In search of profitable opportunities, Bridgewater buys and sells more than a hundred different financial instruments around the world—from Japanese bonds to copper futures traded in London to Brazilian currency contracts—which explains why it keeps a close eye on Greece. In 2007, Dalio predicted that the housing-and-lending boom would end badly. Later that year, he warned the Bush Administration that many of the world’s largest banks were on the verge of insolvency. In 2008, a disastrous year for many of Bridgewater’s rivals, the firm’s flagship Pure Alpha fund rose in value by nine and a half per cent after accounting for fees. Last year, the Pure Alpha fund rose forty-five per cent, the highest return of any big hedge fund. This year, it is again doing very well.

The discussion in the conference room moved on to Spain, the United Kingdom, and China, where, during the previous week, the central bank had raised interest rates in an attempt to slow inflation. Dalio said that the Chinese economy was in danger of overheating, and somebody asked how a Chinese slowdown would affect the price of oil and other commodities. Greg Jensen, Bridgewater’s co-chief executive and co-chief investment officer, who is thirty-six, said he thought that even a stuttering China would still grow fast enough to push world commodity prices upward.

Dalio asked for another opinion. From the back of the room, a young man dressed in a black sweatshirt started saying that a Chinese slowdown could have a big effect on global supply and demand. Dalio cut him off: “Are you going to answer me knowledgeably or are you going to give me a guess?” The young man, whom I will call Jack, said he would hazard an educated guess. “Don’t do that,” Dalio said. He went on, “You have a tendency to do this. . . . We’ve talked about this before.” After an awkward silence, Jack tried to defend himself, saying that he thought he had been asked to give his views. Dalio didn’t let up. Eventually, the young employee said that he would go away and do some careful calculations.

After the meeting, Dalio told me that the exchange had been typical for Bridgewater, where he encourages people to challenge one another’s views, regardless of rank, in what he calls a culture of “radical transparency.” Dalio had no qualms about upbraiding a junior employee in front of me and dozens of his colleagues. When confusions arise, he said, it is important to discuss them openly, even if that involves publicly pointing out people’s mistakes—a process he referred to as “getting in synch.” He added, “I believe that the biggest problem that humanity faces is an ego sensitivity to finding out whether one is right or wrong and identifying what one’s strengths and weaknesses are.”

Dalio is rich—preposterously rich. Last year alone, he earned between two and three billion dollars, and reached No. 55 on the Forbes 400 list. But what distinguishes him more from other hedge-fund managers is the depth of his economic analysis and the pretensions of his intellectual ambition. He is very keen to be seen as something more than a billionaire trader. Indeed, like his sometime rival George Soros, he appears to aspire to the role of worldly philosopher. In October, 2008, at the height of the financial crisis, he circulated a twenty-page essay immodestly titled “A Template for Understanding What’s Going On,” which said the economy faced not just a common recession but a “deleveraging”—a period in which people cut back on borrowing and rebuild their savings—the impact of which would be felt for a generation. This line of analysis wasn’t unique to Dalio, but almost three years later, with economic growth stagnating again, it does not seem off the mark.

Many hedge-fund managers stay pinned to their computer screens day and night monitoring movements in the markets. Dalio is different. He spends most of his time trying to figure out how economic and financial events fit together in a coherent framework. “Almost everything is like a machine,” he told me one day when he was rambling on, as he often does. “Nature is a machine. The family is a machine. The life cycle is like a machine.” His constant goal, he said, was to understand how the economic machine works. “And then everything else I basically view as just a case at hand. So how does the machine work that you have a financial crisis? How does deleveraging work—what is the nature of that machine? And what is human nature, and how do you raise a community of people to run a business?” Dalio is serenely convinced that the precepts he relies on in the markets can be applied to other aspects of life, such as career development and management. And he has enough regard for his own views on these subjects to have collected them in print. Before our meeting, he sent me a copy of his “Principles,” a hundred-page text that is required reading for Bridgewater’s new hires. It turned out to be partly a self-help book, partly a management manual, and partly a treatise on the principles of natural selection as they apply to business. “I believe that all successful people operate by principles that help them be successful,” a passage on the second page said. The text was organized into three sections: “5 Steps to Personal Evolution,” “10 Steps to Personal Decision-Making,” and “Management Principles.” The last of the two hundred and seventy-seven management principles was: “Constantly worry about what you are missing. Even if you acknowledge you are a ‘dumb shit’ and are following the principles and are designing around your weaknesses, understand that you might still be missing things. You will be better and be safer this way.”

Dalio’s philosophy has created a workplace that some call creepy. Last year, Dealbreaker, a Wall Street Web site, picked up a copy of the Principles and made fun of a section in which Dalio appeared to compare Bridgewater to a pack of hyenas feeding on a young wildebeest. In March, AR, a magazine that covers hedge funds, quoted a former colleague of Dalio’s saying, “Bridgewater is a cult. It’s isolated, it has a charismatic leader and it has its own dogma.” The authors of the article noted that Dalio’s “emphasis on tearing down an individual’s ego hints at the so-called struggle groups of Maoism,” while his search for “human perfection devoid of emotion resembles the fantasy world in Ayn Rand’s ‘The Fountainhead.’”

Dalio doesn’t pretend that Bridgewater is a typical workplace, but he is sensitive to criticism. The recent media attention irked him, because, in his view, it misrepresented and trivialized Bridgewater’s culture, which he insists is central to the firm’s success. “It is why we made money for our clients during the financial crisis when most others went over the cliff,” he wrote to me in an e-mail. “Our greatest power is that we know that we don’t know and we are open to being wrong and learning.”

After the “What’s going on in the world?” meeting, he walked back to his office, an airy but modest-sized corner space that overlooks the Saugatuck River and is lined with pictures of his wife and four sons. He sat down behind his desk and showed me a book he had been reading—“Einstein’s Mistakes: The Human Failings of Genius,” by Hans C. Ohanian. “Here was the greatest mind of the twentieth century, and he made lots of mistakes,” Dalio said. In his Principles, Dalio declares that acknowledging errors, studying them, and learning from them is the key to success. He writes, “Pain + Reflection = Progress.” Bridgewater puts this equation into action by organizing lengthy assessment sessions, in which employees must discuss their mistakes.

The next item on Dalio’s agenda was a meeting with his two co-chief executives: Jensen and David McCormick, a former senior official in the Treasury Department under George W. Bush. Like virtually all meetings at Bridgewater, this one was taped. Dalio says that the tapes—some audio, some video—provide an objective record of what has been said; they can be used for training purposes, and they allow Bridgewater’s employees to keep up with what is going on at the firm, including his discussions with senior colleagues. “They get to see all of my mistakes,” Dalio told me. “They get to see all of my humanity.”

Once a tape recorder had been switched on, Jensen, McCormick, and Dalio discussed the possible promotion of an internal candidate to a senior-management role. McCormick, a soft-spoken forty-five-year-old who studied engineering at West Point, argued that the candidate’s prior experience at a big Wall Street firm indicated that he could probably do the job. Dalio disagreed. An investment bank is a “totally different world,” he said. But, rather than continue the discussion, he asked one of his assistants to call in the candidate. One rule of radical transparency is that Bridgewater employees refrain from saying behind a person’s back anything that they wouldn’t say to his face.

The man arrived and stood before Dalio’s desk. Dalio explained what the discussion was about and said, “I don’t imagine that you would be a good fit for the job.” The man took a seat, and Dalio and McCormick continued their discussion about his qualifications. The candidate explained his experience on Wall Street and said he thought he could do the job well. Dalio leaned back in his chair, looking skeptical. The employee didn’t get the promotion. The only child of Italian-American parents, Ray Dalio was born in Jackson Heights, Queens, in 1949. His father was a jazz musician who played the clarinet and saxophone at Manhattan jazz clubs such as the Copacabana; his mother was a homemaker. When Dalio was eight, the family bought a three-bedroom house in Manhasset, and enrolled Ray in the local public school. “I was a bad student,” he recalls. “I have a bad rote memory, and I didn’t like studying.” From the age of twelve, Dalio caddied at the nearby Links Golf Club, whose members included many Wall Street investors. Some of them gave Dalio tips. The first stock he purchased was Northeastern Airlines, which soon received a takeover offer. Its shares tripled. “I figured that this was an easy game,” Dalio said. By the time he started college, at a nearby campus of Long Island University, he had built up a stock portfolio worth several thousand dollars.

After signing up for some finance classes, he discovered that there were some topics he enjoyed studying. Transcendental meditation, which he took up following a trip to India by the Beatles, also helped his work habits. Most mornings before going to the office, he still meditates. Demonstrating his technique, he sat back in his office chair, closed his eyes, and clasped his hands in front of him. “It’s just a mental exercise in which you are clearing your mind,” he said. “Creativity comes from open-mindedness and centeredness—seeing things in a nonemotionally charged way.”

After graduating, Dalio went to Harvard Business School, where he traded commodities—grains, oil, cotton, and so on—for his own account. Not long after leaving Harvard, he landed at Shearson Hayden Stone, the brokerage firm run by Sanford Weill. Dalio worked in the commodity-futures department, advising cattle ranchers, grain producers, and others on how to hedge risks. (The horns of a longhorn steer, the gift of some California ranchers, are mounted behind his desk.) On New Year’s Eve in 1974, Dalio went out drinking with his departmental boss, got into a disagreement, and slugged him. About the same time, at the annual convention of the California Food & Grain Growers’ Association, he paid an exotic dancer to drop her cloak in front of the crowd. After being fired, he persuaded some of his clients to hire him as a consultant and founded Bridgewater, operating it out of his two-bedroom apartment. He was twenty-six years old.

By the early nineteen-eighties, Dalio had got married, started a family, and moved to Wilton, Connecticut, where he lived and traded out of a converted barn. He also advised businesses on how to manage risk and published an economic newsletter. One of his readers was Bob Prince, a young financial analyst who worked for a bank in Oklahoma, and who is now Bridgewater’s co-chief investment officer. Prince showed one of Dalio’s articles to his boss, David Moffett, who went on to become the chief executive of Freddie Mac. “He said it was the best thing he had ever read on how the economy works,” Prince recalled. Another of Dalio’s articles that stuck in Prince’s memory was titled “What Is a Jeweler?” It described a jeweller as basically an investor with a long position in gold and precious stones. If the market price of these commodities goes up, the jeweller makes money on his stock. If prices fall, he can lose out. To limit the risk, Dalio wrote that jewellers should purchase gold-futures contracts designed to rise in value when the price of gold falls.

In 1985, Dalio persuaded the World Bank’s employee-retirement fund to let Bridgewater manage some of its capital. In 1989, Kodak’s retirement system did the same. At the time, Kodak had most of its money invested in stocks. Dalio’s pitch, which hasn’t changed much over the years, was that by investing in a variety of other markets, such as U.S. and international bonds, and using leverage to bolster its exposure, Bridgewater could match or beat the stock market with less risk. “He had a new way of thinking,” Rusty Olson, who ran Kodak’s retirement funds for many years, told me. “You get the same return, but you get a heck of a lot of beneficial diversification, too.”

Hedge funds date to 1949, when Alfred Winslow Jones, a writer at Fortune, opened a private investment firm using sixty thousand dollars he had raised from friends and forty thousand he had saved. To boost his returns, Jones borrowed heavily and bought stocks he liked “on margin”—a practice that had been discredited in the late nineteen-twenties. As a “hedge” against the market falling, Jones also picked out some stocks he believed to be overvalued and bet against them—a practice known as “selling short.” Jones’s fund regularly beat the Dow, and by the late nineteen-sixties it had attracted many imitators.

Worldwide, there are now some ten thousand hedge funds, which the government regulates only loosely. Together, they have about two trillion dollars under management. Even today, they employ the two basic tools that Jones used—borrowing (“leverage”) and selling short—and they charge their clients hefty fees, as Jones did. On top of a two-per-cent management fee, they deduct twenty per cent of any investment gains they generate. Jones claimed that this remuneration scheme, which is known as “two and twenty,” was inspired by the way ancient Phoenician merchants financed their trading expeditions. But the practice is also tax-driven. It allows hedge-fund managers to classify much of their income as capital gains, which are taxed at a far lower rate than regular income. While cops and schoolteachers face a marginal tax rate of twenty-five per cent, hedge-fund managers like Dalio have for years paid fifteen per cent on the lion’s share of their income.

Some hedge-fund managers, such as Steven A. Cohen, of S.A.C. Capital, and David Einhorn, of Greenlight Capital, are stock pickers, like Jones. Others, such as James Simons, of Renaissance Technologies, are known as “quants.” They use computers to sift through market data, spot profitable opportunities, and place trades, all with minimal human intervention. As a macro trader, Dalio is working in the tradition of George Soros and Julian Robertson, famous speculators who ranged across markets.

Bridgewater has long run two primary investment funds. One, called All Weather, has low charges attached to it and seeks to match the over-all market return, which is known as “beta,” in whichever market the client chooses. Another, Pure Alpha, which has the standard two-and-twenty charges, aims at beating the market return but also at limiting risk. To investment professionals, “alpha” is the return over and above the market return. If in a given year the S. & P. 500 returns fifteen per cent and an equity-fund manager generates a return of twenty per cent, his alpha is five per cent.

Part of Dalio’s innovation has been to build a hedge fund that caters principally to institutional investors rather than to rich individuals. Of the roughly one hundred billion dollars invested in Bridgewater, only a small proportion comes from wealthy families. Almost a third comes from public pension funds, such as the Pennsylvania Public School Employees’ Retirement System; another third comes from corporate pension funds, such as those at Kodak and General Motors; a quarter comes from government-run sovereign wealth funds, such as the Government Investment Corporation of Singapore. “Making money on a constant basis is the holy grail, and Ray and Bridgewater have done that,” Ng Kok-Song, the chief investment officer of the Singapore fund, told me. “They are consistently innovating—constantly soul-searching and asking, ‘Have we got this right?’ ” Kok-Song went on, “I am constantly asking myself, ‘If Bridgewater is doing this, shouldn’t we be doing the same thing?’ ”

At some hedge funds, client service is an afterthought. Bridgewater’s investors receive a daily newsletter, monthly performance updates, quarterly reviews, and conference-call briefings from Dalio and other senior executives. “When a lot of folks were very, very secretive, Ray could see the value in creating something that was more open, something that was attractive to very large streams of money,” Robert Johnson, a former senior executive at Soros Fund Management, who now runs the Institute for New Economic Thinking, said to me. Recently, the hedge-fund industry has been shaken by allegations that it exploits inside information. In May, Raj Rajaratnam, the founder of the Galleon Group, was convicted on fourteen counts of conspiracy and securities fraud. Other government investigations are continuing, including one involving S.A.C. Capital. Dalio and Bridgewater don’t appear to be involved. Dalio told me that Bridgewater hasn’t received any subpoenas, adding that he had no reason to believe that the firm was under investigation by any official agency. Dalio is an outdoorsman and naturalist of the Hemingway school: he likes to go places and kill things. He fishes in Canada, shoots grouse in Scotland, and hunts big game in Africa, with a bow—particularly Cape buffalo, which weigh up to two thousand pounds, are famously ornery, and sometimes gore hunters with their giant horns. Naturally, Dalio sees this as a metaphor for how he invests. “It’s always a matter of controlling risk,” he explained. “Risky things are not in themselves risky if you understand them and control them. If you do it randomly and you are sloppy about it, it can be very risky.” The key to success, he said, is figuring out “Where is the edge? And how do I stay the right distance from the edge?” One way he does it is by spreading his bets: at any given time, the Pure Alpha fund typically has in place about thirty or forty different trades. “I’m always trying to figure out my probability of knowing,” Dalio said. “Given that I’m never sure, I don’t want to have any concentrated bets.” Such thinking runs counter to the conventional wisdom in the hedge-fund industry, which is that the only way to score big is to bet the house. George Soros famously did this in 1992—selling short some ten billion dollars’ worth of sterling. A few years ago, John Paulson wagered hugely against U.S. mortgage bonds and made several billion dollars.

Dalio is a consistent hitter of singles and doubles—the José Reyes of Wall Street. Among the bets the Pure Alpha fund placed last year were long positions in Treasury bonds, the Japanese yen, and gold, and short positions in the euro and European sovereign debt. A potential problem with this type of global investing is that these days many markets move in the same direction, which makes it hard to achieve real diversification. Bridgewater’s solution is to place a lot of “spread” bets, purchasing one security it considers undervalued and selling short another one it considers overvalued. For example, it might buy platinum and sell silver, or buy a thirty-year U.K. bond and sell a ten-year bond. The returns from spread bets tend to be uncorrelated with the over-all market.

Other hedge funds have tried to mimic Dalio’s approach, which is sometimes referred to as “portable alpha,” but none have proved as successful. The strategy depends on an ability to outperform the market consistently, which many economists regard as virtually impossible. Dalio somehow seems to manage it.

At the start of the year, Bridgewater turned bearish on U.S. bonds and built up a short position. When the bond market stumbled, this bet (which the firm has since reversed) paid off handsomely, as did wagers on commodities and emerging-market currencies. So far in 2011, while the average hedge fund has struggled to make any money at all, the Pure Alpha fund is up more than ten per cent. The bet against Treasuries gave the lie to a criticism sometimes made of Dalio—that he is basically a bond-market investor, who has benefitted from a twenty-year rally in bonds. “We have been equally likely to be short bonds or long bonds,” he said. “The performance of the Pure Alpha fund is not correlated with any asset class or any market. It has done equally well in any environment.”

What accounts for Dalio’s success? His colleague Bob Prince describes him as “a big-picture thinker connected to a street-smart” trader. Many economists start at the top and work down. They look at aggregate statistics—inflation, unemployment, the money supply—and figure out what the numbers mean for particular industries, such as autos or tech. Dalio does things the other way around. In any market that interests him, he identifies the buyers and sellers, estimates how much they are likely to demand and supply, and then looks at whether his findings are already reflected in the market price. If not, there may be money to be made. In the U.S. bond market, Bridgewater scrutinizes the weekly U.S. Treasury auctions to see who is buying—American banks, foreign central banks, mutual funds, pension funds, rival hedge funds—and who isn’t. In the commodities markets, the firm goes through a similar exercise, trying to figure out how much demand is coming from corporations and how much from speculators. “It all comes down to who is going to buy and who is going to sell and for what reasons,” Dalio explained.

To guide its investments, Bridgewater has put together hundreds of “decision rules.” These are the financial analogue of Dalio’s Principles. He used to write them down and keep them in a ring binder. Today, they are encoded in Bridgewater’s computers. Some of these indicators are very general. One of them says that if inflation-adjusted interest rates decline in a given country, its currency is likely to decline. Others are more specific. One says that, over the long run, the price of gold approximates the total amount of money in circulation divided by the size of the gold stock. If the market price of gold moves a long way from this level, it may indicate a buying or selling opportunity.

In any given market, Bridgewater may have a dozen or more different indicators. However, even when most or all of the indicators are pointing in a certain direction, Dalio doesn’t rely solely on software. Unless he and Jensen and Prince agree that a certain trade makes sense, the firm doesn’t make it. While this inevitably introduces an element of human judgment to the investment process, Dalio insists it is still driven by the rules-based framework he has built up over thirty years. “When I’m thinking, ‘What is going on today?,’ I also need to make the connection to ‘How does what is happening today fit into our framework for making this decision?’ ’’ he said. Ultimately, he says, it is the commitment to systematic analysis and systematic investment that distinguishes Bridgewater from other hedge funds. “I hear a lot of people describing what’s happening today without the proper historical context and without the framework of how the machine works,” he says.

In looking at the economy as a whole, Dalio pays particular attention to the amount of credit that banks and other financial institutions are creating, which he regards as a key factor in over-all spending. This may seem like common sense, but until recently many economists and policymakers didn’t pay much heed to the growth of credit, concentrating instead on the amount of actual money in the economy—notes, coins, bank deposits—which is largely determined by the Federal Reserve. In July, 2007, Dalio and a co-author wrote in Bridgewater’s daily newsletter about “crazy lending and leveraging practices,” adding, “We want to avoid or fade this lunacy.” A couple of weeks later, after the subprime-mortgage market froze up, Dalio’s newsletter declared, “This is the financial market unraveling we have been expecting. . . . This will run through the system with the speed of a hurricane.” Searching for historical precedents, Bridgewater put together detailed histories of previous credit crises, going back to Weimar Germany. The firm’s researchers also went through the public accounts of nearly all the major financial institutions in the world and constructed estimates of how much money they stood to lose from bad debts. The figure they came up with was eight hundred and thirty-nine billion dollars. Armed with this information, Dalio visited the Treasury Department in December, 2007, and met with some of Treasury Secretary Henry Paulson’s staff. Nobody took much notice of what he said, but he went on to the White House, where he presented his numbers to some senior economic staffers. “Ray laid out the argument that the losses he foresaw in the banking system were astronomical,” a former Bush Administration official who attended the White House meeting recalled. “Everybody else was talking about liquidity. Ray was talking about solvency.”

His warnings ignored in Washington, Dalio issued more jeremiads to his clients. “If the economy goes down, it will not be a typical recession,” his newsletter said in January, 2008. Rather, it would be a disaster in which “the financial deleveraging causes a financial crisis that causes an economic crisis. . . . This continues until there is a reflation, a currency devaluation and government guarantees of the efficacy of key financial intermediaries.” As the crisis deepened, Dalio continued to assess it far more accurately than many senior policymakers did. When the government allowed Lehman Brothers to collapse, he despaired. “So, now we sit and wait to see if they have some hidden trick up their sleeves, or if they really are as reckless as they seem,” the newsletter said on September 15, 2008.

Eventually, after the near implosion of the financial system had brought about a deep recession, some policymakers came to respect Dalio’s analysis. “I think the central policy judgment was that there was more risk in doing too little than in doing too much,” Lawrence Summers, who headed the National Economic Council between 2009 and 2010, recalled. “That was a judgment I reached, and it was a judgment Ray reached.” While Summers was in the White House, he read Bridgewater’s economic newsletter and spoke every few months with Dalio, whom he described to me as “an impressively intellectually aggressive guy.” Summers went on, “He had a fully articulated way of looking at the economy. I’m not sure I would agree with all of it, but it seems to have been a very powerful analytical tool through this particular period.”

And a powerful investment tool, too. Anticipating that the Federal Reserve would be forced to print a lot of money to revive the economy, Bridgewater placed a number of bets that would pay off in such a scenario—for instance, going long Treasury bonds, shorting the dollar, and buying gold and other commodities. These trades helped the Pure Alpha fund make money in 2008, but Dalio’s bearishness cost him in 2009. Despite the Fed’s actions and the Obama Administration’s stimulus package, Dalio predicted that the economic recovery would be weak. When growth rebounded faster than he expected and the Dow rose nineteen per cent, the Pure Alpha fund gained just four per cent. But last year, when G.D.P. growth faltered, the fund made a great deal of money betting on Treasury bonds and other securities that tend to do well in a weak economy.

In April, an article in New York ridiculed Dalio’s Principles, saying that they read “as if Ayn Rand and Deepak Chopra had collaborated on a line of fortune cookies.” It also accused him of running Bridgewater like a cult. “I’ve been surprised that there’s been so much controversy about us having such clearly set-out principles, especially since they’re all about being truthful and transparent to do good work and have meaningful relationships,” Dalio wrote to me subsequently. “Most of the people who don’t like us having them haven’t read them—they just assume that us having a lot of principles makes us a cult. That’s O.K. I figure that the people who matter to us will take the time to read them and form their own opinions and those who don’t care enough to read them don’t matter to us.”

Dalio may protest too much. The word “cult” clearly has connotations that don’t apply to an enterprise staffed by highly paid employees who can quit at any moment. But Bridgewater’s headquarters are in the woods, isolated from any other financial institution; Dalio is a strong-willed leader; and the employees do use their own vocabulary—Dalio’s vocabulary. Bob Elliott, a twenty-nine-year-old Harvard graduate who has worked at Bridgewater for six years, told me earnestly, “Once you understand how the machine works, you have the ability to take that and study and apply it across markets.” It’s also the case that in the time I spent at the firm I saw senior people criticizing subordinates—but not the reverse.

In his Principles, Dalio acknowledged that his firm can seem strange to outsiders and newcomers: “Since Bridgewater’s culture is very different from what is typical in the world at large, people often encounter culture shock when they start here.” In part to minimize this shock, for years Bridgewater recruited young men and women straight out of college. (Harvard, Princeton, and Dartmouth were favorite targets.) But the firm’s in-your-face attitude—and the relentless pressure to perform—takes its toll. “We get a lot of people who self-select out of that pretty quickly,” Michael Partington, a recruiter at Bridgewater, said to me. Within two years of arriving at Bridgewater, about a quarter of new hires have quit or been let go.

Bridgewater has been expanding rapidly—it now has more than a thousand people on its payroll—and it has brought in a lot of mid-career executives. One day, I drove to Westport and sat in on a management-committee meeting, which had been set up for the purpose of “getting in synch” with a recent recruit, whom I’ll call Peter and who had come from a big financial firm. All nine members of Bridgewater’s management committee were sitting at a long wooden conference table. Peter, a lean man with fair hair, sat stiffly near the front: he looked like somebody anticipating a root canal. Jensen and McCormick were nominally in charge, but Dalio took over, telling Peter that, during a previous management meeting, he had answered emotionally in response to questioning from Jensen. “This is a common thing when somebody’s getting probed,” Dalio said. “Because the amygdala gets stimulated and you have that emotional reaction.” Peter agreed that he had become upset, especially when he sensed he was being accused of misleading his colleagues. “I felt in some sense my integrity was being attacked,” he said. “That’s when things spiralled out of control.”

Dalio walked to the front of the room, where he wrote on a whiteboard, “felt,” “integrity,” and “misled.” “?‘Felt’ is the key word here . . . and it’s a challenge for people,” he said. After a bit more discussion, he went on, “What we’re trying to have is a place where there are no ego barriers, no emotional reactions to mistakes. . . . If we could eliminate all those reactions, we’d learn so much faster.” Another member of the committee, Eileen Murray, intervened to say she assumed that Peter had not encountered this type of conversation at his previous job. He confirmed that he hadn’t. Murray nodded sympathetically. “When I first came here, I was like, ‘What the hell is going on?’ ” she said.

Dalio wasn’t finished. He suggested that the problem was that Peter had an idea of how things should be handled, and when the reality turned out to be different he hadn’t been honest with his colleagues. “The issue is that you are not freely releasing those beliefs,” he said to Peter. “Unlike a lot of companies, where you are meant to sit there and be quiet . . . here we respect your notion that you have a point of view. . . . Your responsibility is to say, ‘Does it make sense to me?’ And if it doesn’t make sense don’t keep it bottled up.” Dalio went on, “I’m saying, just let it flow, man.”

Peter said he thought it was understandable that somebody new to the firm would react under stress as he had. Still, he added, “If I had to replay this thing again, I’d be much more open with my thoughts.” “What would you say the duty of a leader is?” Dalio asked him. Peter replied, “The duty of a leader, first and foremost, is to be transparent.” Bridgewater’s decision rules surely contribute to his firm’s success. But Dalio also believes that his management principles play a role. “What is a typical organization?” he asked me one day. “A typical organization is one where people are walking around saying, ‘This is stupid, this doesn’t make sense,’ behind each other’s backs.” In support of his management theories, Dalio has an expert witness. “About eighty-five per cent of what’s in the Principles could be documented and supported by research,” Bob Eichinger, an organizational psychologist who has done consulting work for Bridgewater and other large companies, said. Eichinger went on, “Is it a better way to run a company? From a results perspective, probably so. Could a large portion of the working population be comfortable in that environment? Probably not.”

Some senior executives at Bridgewater do relish working there. Eileen Murray, who runs the firm’s accounting and technology systems, is one of them. Before moving to Bridgewater, in 2009, she spent twenty-five years on Wall Street, rising to a senior post at Morgan Stanley. “I wanted to make sure I wasn’t joining some petri dish in Westport, Connecticut, as part of a big experiment,” she said, recalling her initial, lengthy conversations with Dalio. “If someone’s intention is to make me a better person, I really appreciate that. If people do things because they can, or because they are the boss . . . I don’t react to that well.” Murray said she is now reassured, because “the intention is to make people better. . . . I have never seen a C.E.O. spend as much time developing his people as Ray.”

Another new member of Bridgewater’s management committee is James Comey, the firm’s top lawyer, who served as Deputy Attorney General in the Bush Administration between 2003 and 2005. “Most of my friends think I am having a midlife crisis,” Comey told me in a recent phone conversation, referring to his decision, last year, to leave Lockheed Martin and accept an offer from Dalio. He was tired of corporate politics and craved a setting where people spoke truth to power, but, he said, it took him a while to get used to dealing with Dalio. “When Ray sent me an e-mail saying, ‘I think what you said today doesn’t make sense,’ I tended to think, What does he really mean? Where’s he coming from? And what is my play? Who are my allies? All of the things you think about in the outside world. It took me three months to realize that when Ray says, ‘I think you are wrong,’ he really means ‘I think you are wrong.’ He’s not trying to provoke you, or anything else.”

Comey was initially struck by how long it took Bridgewater to make decisions, because of the ceaseless internal debates. “I said, ‘Lordy, we have to put tops on bottoms. Let’s get something done,’ ” Comey recalled. But he added, laughing, “The mind control is working. I’ve come to believe that all the probing actually reduces inefficiencies over the long run, because it prevents bad decisions from being made.” Comey said of Dalio, “He’s tough and he’s demanding and sometimes he talks too much, but, God, is he a smart bastard.” And yet Dalio’s acuity prompts an awkward question: how much of Bridgewater’s success comes not from the way it is organized, or any notion of “radical transparency,” but from the boss’s raw investment abilities? At other hedge funds, it is taken for granted that the firm’s principal asset walks out the door every evening and settles into a chauffeur-driven car. Is Bridgewater really any different? Although the firm trades in more than a hundred markets, it is widely believed that the great bulk of its profit comes from two areas in which Dalio is an expert: the bond and currency markets of major industrial countries. Unlike some other hedge funds, Bridgewater has never made much money in the U.S. stock market, an area where Dalio has less experience. “Bridgewater really is Ray,” one former employee told me. “The key decisions they have made—where they have really made their money—is Ray. Most of what really matters is Ray, with help from Greg and Bob. You could run the firm with forty or fifty people instead of a thousand, and it would be basically the same.” As long as Dalio remains healthy, the fact that he plays a key role in directing Bridgewater’s investments isn’t an issue. (Based on past experience, it is a big advantage.) But, from a business and marketing perspective, the suggestion that Bridgewater’s success continues to hinge on Dalio is a problematic one. As the former employee explained, “It’s hard to market that model—one guy and his brilliant track record. If you want to sell your firm to institutional clients, it’s critical to appear to be ‘rule-driven.’ That takes a lot of smarts. Most people want to take the credit. To say ‘I just run this machine’ detracts from your own individual brilliance. But that is very smart business.”

Dalio contests this account. He insists that he is but one member of a large team, with Greg Jensen and Bob Prince acting as his co-chief investment officers. He compares the comments of former employees to the carping of ex-spouses. In fact, with the firm prospering, Dalio has been living up to a promise to spend a bit more time away from it, and he has ceded some day-to-day management responsibility to Jensen and McCormick. “I’m stepping back a little: I’m going to a minister/mentor role,” Dalio said, comparing himself to Lee Kuan Yew, the longtime Prime Minister of Singapore, who relinquished his post in 1990 but even today retains great influence. This month, Dalio is formally giving up his co-C.E.O. title in favor of “Mentor.”

The managerial changes and Dalio’s lean appearance have ignited some speculation that he is sick, but he insisted to me that he is fine. He said his weight loss was the result of an “intended weight-loss program,” and he said he has absolutely no intention of giving up his role in directing Bridgewater’s investments. In stepping back from day-to-day management and in bringing in senior people, he said he is seeking to preserve the essence of the firm he built while preparing it for his eventual departure. Bridgewater has grown so large that its two main funds are now closed to new investors. Recently it launched a third fund, which is called Pure Alpha Major Markets.

Last year, Dalio sold about twenty per cent of Bridgewater to some of its employees in a deal financed by several of the firm’s longtime clients, and he told me that ultimately he would like to sell his entire ownership stake to his colleagues. Unlike certain other hedge-fund managers, though, he has no interest in making another fortune by floating his firm on the stock market. “I don’t want Bridgewater to go public or have it controlled by anybody outside the firm,” he said. “I think people who do that tend to mess up the firm.” Dalio insists that money has never been his main motivation. He lives well, but avoids the conspicuous consumption that some of his rivals indulge in. He and his wife, Barbara, to whom he has been married for thirty-four years, own two houses, one in Greenwich, Connecticut, and one in Greenwich Village, which he sometimes uses on weekends. (They are currently building a new house on the water in Connecticut.) Apart from hunting and exploring remote areas, Dalio’s main hobby is music: jazz, blues, and rock and roll. Recently, he joined a philanthropic campaign started by Bill Gates and Warren Buffett, pledging to give away at least half of his money. (Forbes estimates his net worth at six billion dollars.) He and his wife wrote in a public letter, “We learned that beyond having enough money to help secure the basics—quality relationships, health, stimulating ideas, etc.—having more money, while nice, wasn’t all that important.”

Not that Dalio makes any apology for his fortune or his profession. An agnostic and a self-described “hyperrealist,” he regards it as self-evident that all social systems obey nature’s laws, and that individual participants get rewarded or punished according to how far they operate in harmony with those laws. He views the financial markets as simply another social system, which determines payoffs and punishments in a like manner. “You have to be accurate,” he says. “Otherwise, you are going to pay. Alpha is zero sum. In order to earn more than the market return, you have to take money from somebody else.”

Dalio is right, but somewhat self-serving. If hedge-fund managers are playing a zero-sum game, what is their social utility? And if, as many critics contend, there isn’t any, how can they justify their vast remuneration? When I put these questions to Dalio, he insisted that, through pension funds, Bridgewater’s investors include teachers and other public-sector workers, and that the firm created more value for its clients last year than Amazon, eBay, and Yahoo combined. However, it is one thing to say that the most successful hedge-fund managers earn the riches they reap. It is quite another to suggest that the entire industry serves a social purpose. But that is Dalio’s contention. “In aggregate, it really contributes a lot to the efficiency of capital allocation, and capital allocation is very important,” he said.

Like many successful financiers, Dalio justifies capitalism and his place in it as a Darwinian process, in which the over-all logic of the system is sometimes hidden. This is actually what the mention, in his Principles, of hyenas savaging a wildebeest was about. “Is this good or bad?” he wrote. Like “death itself, this behavior is integral to the enormously complex and efficient system that has worked for as long as there has been life.” Of course, this view conveniently ignores the argument that hedge funds, through their herd behavior, have contributed to speculative bubbles, in tech stocks, oil, and other commodities. Even some defenders of the industry concede that the problem is real and potentially calamitous. “There is a basis for the argument that hedge funds add economic value,” Andrew Lo, an economist at M.I.T. who runs his own hedge fund, says. “At the same time, they create systemic risks that have to be weighed against those positives.”

Because hedge funds use a lot of borrowed money to magnify their bets, they are subject to rapid reversals: the history of the industry is littered with blowups. This wouldn’t matter much if other parts of the economy weren’t affected by the actions of hedge funds, but sometimes they are. In 2008, hedge funds had hundreds of billions of dollars on deposit at investment banks, which acted as their brokers and counterparties on many trades. When the Wall Street firms got into trouble, a number of other hedge funds demanded their money back immediately. These demands amounted to a virtual run on the banks and helped to bring down Bear Stearns and Lehman Brothers. Dalio acknowledged to me that Bridgewater was one of the funds that pulled a lot of money out of Lehman and other Wall Street firms, but he said he had little choice. “I’m a fiduciary to my clients. My responsibility is to know where it’s risky and where it’s not risky, and to get out of the risks.”

Hedge funds have also contributed to the radical increase in income inequality. Fifteen years ago on Wall Street, remuneration packages of five or ten million dollars a year were rare. Today, C.E.O.s and star traders routinely demand vastly higher sums to keep up with their counterparts at hedge funds. In addition to distorting salary structures elsewhere, the rewards that hedge-fund managers reap draw some of the very brightest science and mathematics graduates to the industry. Can it really be in America’s interest to have so much of its young talent playing a zero-sum game?

Rather than confronting these issues, Dalio, like all successful predators, is concentrating on the business at hand—the markets and the global economic outlook. This spring, he told me that economic growth in the United States and Europe was set to slow again. This was partly because some emergency policy measures, such as the Obama Administration’s stimulus package, would soon come to an end; partly because of the chronic indebtedness that continues to weigh on these regions; and partly because China and other developing countries would be forced to take drastic policy actions to bring down inflation. Now that the slowdown appears to have arrived, Dalio thinks it will be prolonged. “We are still in a deleveraging period,” he said. “We will be in a deleveraging period for ten years or more.”

Dalio believes that some heavily indebted countries, including the United States, will eventually opt for printing money as a way to deal with their debts, which will lead to a collapse in their currency and in their bond markets. “There hasn’t been a case in history where they haven’t eventually printed money and devalued their currency,” he said. Other developed countries, particularly those tied to the euro and thus to the European Central Bank, don’t have the option of printing money and are destined to undergo “classic depressions,” Dalio said. The recent deal to avoid an immediate debt default by Greece didn’t alter his pessimistic view. “People concentrate on the particular thing of the moment, and they forget the larger underlying forces,” he said. “That’s what got us into the debt crisis. It’s just today, today.”

Dalio’s assessment sounded alarmingly plausible. But when one plays the global financial markets a thorough economic analysis is only the first stage of the game. At least as important is getting the timing right. I asked Dalio when all this would start to come together. “I think late 2012 or early 2013 is going to be another very difficult period,” he said.

Philip Leakey

-

We are born with what some psychologists call an "explanatory drive." You give a baby a strange object or something that doesn’t make sense and she will become instantly absorbed; using all her abilities — taste, smell, force — to figure out how it fits in with the world.

I recently met someone who, though in his seventh decade, still seems to be gripped by this sort of compulsive curiosity. His name is Philip Leakey.

He is the third son of the famed paleoanthropologists Louis and Mary Leakey and the brother of the equally renowned scholar, Richard Leakey. Philip was raised by people whose lives were driven by questions. Parts of his childhood were organized around expeditions to places like Olduvai Gorge where Louis and most especially Mary searched for bones, footprints and artifacts of early man. The Leakeys also tend to have large personalities. Strains of adventurousness, contentiousness, impulsivity and romance run through the family, producing spellbinding people who are sometimes hard to deal with.

Philip was also reared in the Kenyan bush. There are certain people whose lives are permanently shaped by their frontier childhoods. They grew up out in nature, adventuring alone for long stretches, befriending strange animals and snakes, studying bugs and rock formations, learning to fend for themselves. (The Leakeys are the sort of people who, when their car breaks down in the middle of nowhere, manage to fix the engine with the innards of a cow.)

This sort of childhood seems to have imprinted Philip with a certain definition of happiness — out there in the bush, lost in some experiment. Naturally, he wasn’t going to fit in at boarding school.

At 16, he decided to drop out and made a deal with his parents. He would fend for himself if they would hire a tutor to teach him Swahili. Kenya has 42 native tribes, and over the next years Phillip moved in with several. He started a series of small businesses — mining, safari, fertilizer manufacturing and so on. As one Kenyan told me, it’s quicker to list the jobs he didn’t hold than the ones he did.

The Leakey family has been prolifically chronicled, and in some of the memoirs Philip comes off as something of a black sheep, who could never focus on one thing. But he became the first white Kenyan to win election to Parliament after independence, serving there for 15 years.

I met him at the remote mountain camp where he now lives, a bumpy 4-hour ride south of Nairobi near the Rift Valley. Leakey and his wife Katy — an artist who baby-sat for Jane Goodall and led a cultural expedition up the Amazon — have created an enterprise called the Leakey Collection, which employs up to 1,200 of the local Maasai, and sells designer jewelry and household items around the world.

The Leakeys live in a mountaintop tent. Their kitchen and dining room is a lean-to with endless views across the valley. The workers sit out under the trees gossiping and making jewelry. Getting a tour of the facilities is like walking through Swiss Family Robinson or Dr. Dolittle.

Philip has experiments running up and down the mountainside. He's trying to build an irrigation system that doubles as a tilapia farm. He's trying to graft fruit trees onto native trees so they can survive in rocky soil. He's completing a pit to turn cow manure into electricity and plans to build a micro-hyrdroelectric generator in a local stream.

Leakey and his workers devise and build their own lathes and saws, tough enough to carve into the hard acacia wood. They’re inventing their own dyes for the Leakey Collection’s Zulugrass jewelry, planning to use Marula trees to make body lotion, designing cement beehives to foil the honey badgers. They have also started a midwife training program and a women’s health initiative.

Philip guides you like an eager kid at his own personal science fair, pausing to scratch into the earth where Iron Age settlers once built a forge. He says that about one in seven of his experiments pans out, noting there is no such thing as a free education.

Some people center their lives around money or status or community or service to God, but this seems to be a learning-centered life, where little bits of practical knowledge are the daily currency, where the main vocation is to be preoccupied with some exciting little project or maybe a dozen.

Some people specialize, and certainly the modern economy encourages that. But there are still people, even if only out in the African wilderness, with a wandering curiosity, alighting on every interesting part of their environment.

The late Richard Holbrooke used to give the essential piece of advice for a question-driven life: Know something about something. Don’t just present your wonderful self to the world. Constantly amass knowledge and offer it around.

Alan Whicker

-

Alan Whicker, who has died aged 87, once said he was the only person who really was interested in other people’s holiday snaps. It was this innate sense of curiosity that drove his career as a reporter and presenter. Over five decades, he went from being a war correspondent to unearthing the impressive and bizarre in his series Whicker’s World.

His dapper figure, inevitably clothed in neatly pressed slacks, blazer and regimental-style tie, made him one of the most recognised figures on television. His scripts had a full quota of alliteration and puns, and his slightly nasal delivery was distinctive — and much mimicked, most notably by Monty Python. His interviewing technique was relaxed, and he never shirked an awkward or embarrassing question. The secret, he said, was to ask it agreeably.

Three years after Whicker’s birth in Cairo, his family moved to Richmond in Surrey. His father, a former army officer, became ill and died soon after the move.